Within financial services, we are at an inflection point. Enormous innovation-driven changes are happening at a faster and more substantial pace.

In an effort to better understand how disruptive innovation is reshaping the financial services landscape, Oliver Wyman has partnered with the World Economic Forum (WEF) on a multi-year initiative Balancing Financial Stability, Innovation, and Economic Growth (FSIEG). Our collaboration brings together senior industry representatives and experts from prominent banks, insurance, fintech companies and the public sector. A particular focus of the work has been to understand the trade-offs between the customer service and economic growth benefits of innovation, and the need to manage systemic risks.

Fintech players are changing the marketplace

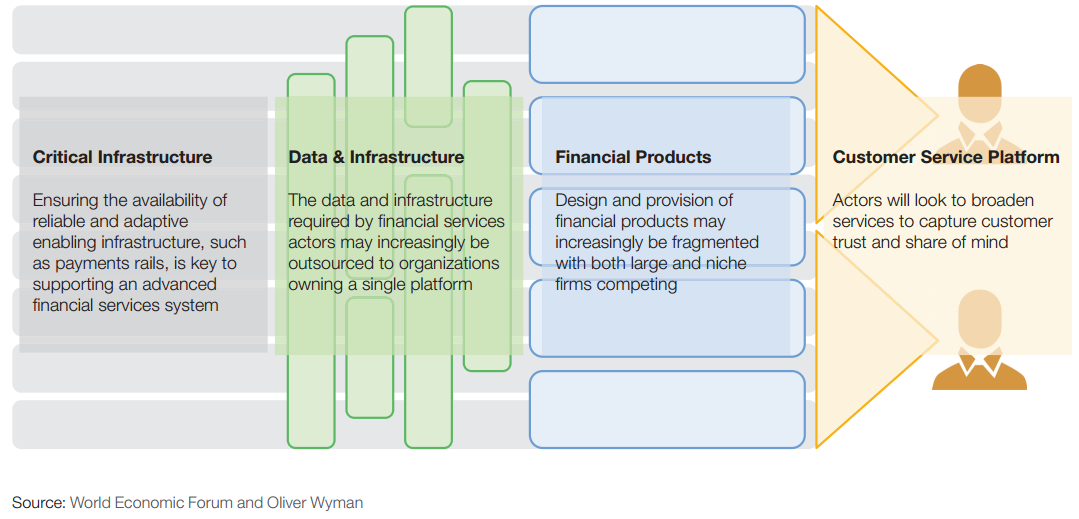

As new fintech players enter the marketplace and rapidly revolutionize customer expectations, the financial sector is undergoing an overarching shift towards an increasingly modular system. In the past, banks and financial institutions would own the entire client service relationship, develop the products and maintain the end-to-end infrastructure.

Today, that business model is split between different organizations. We see firms partnering with more providers to create customer-service platforms, specialized products and data infrastructures that deliver faster, better, smoother and friction-free outcomes to customers. There are many benefits to this shift, but it also means players face challenges with managing new systemic risks, such as cyber risk, data theft and the inappropriate use of customer information.

Our collaboration with the World Economic Forum As part of the FSIEG initiative, the Forum has held a series of roundtable discussions and completed interviews with industry executives and experts to examine the technological transformation taking place in financial services. This white paper provides a summary of findings identified during the ongoing discussions and interviews, which at a very high level can be condensed in the following four points:

- Further major innovation-driven change is coming in financial services.

- Joint, concerted action is needed to enable the system to reap the benefits of innovation.

- Managing some systemic risks introduced by this wave of innovation poses challenges.

- The financial services system would benefit from certain tools to achieve greater enablement and risk management.

Visualization of Future State of the Financial Services Sector

More collective action between industry participants will ignite change and help to realize significant benefits. These changes may occur in the following areas: