This article was updated on March 31, 2020 with the US CARES ACT changes.

As the first CECL reporting date approaches on March 31, 2020, COVID-19 continues to rapidly spread around the world, causing demand shocks and supply shocks.

In June 2016, the Financial Accounting Standards Board (FASB) released the final standard for allowances for credit losses — known as Current Expected Credit Loss (CECL) — leading lenders, analysts and investors to attempt to estimate the day one impact of CECL for institutions with publicly listed securities (“SEC filers”). A common caveat has been that the estimates assumed a benign base-case forecast of economic conditions, and that if conditions worsened leading up to March 31, 2020, the impact could be much larger.

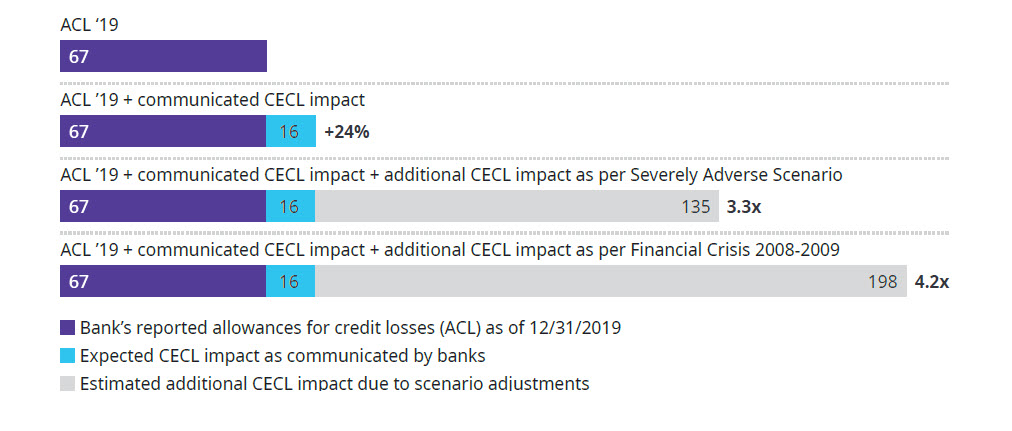

Our analysis suggests that CECL allowances of the largest US banks might triple or even quadruple if a severely adverse economic scenario, similar to the financial crisis of 2008-09, were fully factored into CECL estimates

Markets have reacted quickly to COVID-19 and drastic containment measures: The S&P 500 has lost around 30 percent since its peak on February 19, 2020; the VIX, the Chicago Board Options Exchanges (CBOE) market volatility measure, hit 83 percent on March 16, 2020 surpassing its highest levels in 2008; and interest rates are reaching new lows. Economists are quickly downgrading their economic forecasts, with double-digit declines in GDP expected by some analysis in Q2.

Congress has recognized the challenges and included some relief in the Coronavirus Aid, Relief, and Economic Security (CARES) Act, which was signed into law by the President on March 27, 2020. This gives insured depository institutions, bank holding companies, and affiliates an option to delay implementation of CECL until the earlier of December 31, 2020 or the date on which the national emergency concerning COVID-19 terminates.

Supervisory agencies have also recognized the challenges posed by CECL in this environment. On March 27, 2020, the Office of the Comptroller of the Currency (OCC), Federal Reserve and Federal Deposit Insurance Corporation (FDIC) released a joint regulatory capital rule providing (in addition to the previously-announced capital phase in option for CECL) a new option for phasing in the impacts of CECL into regulatory capital over the next five years, including a full offset for two years of an estimate of the impact of CECL versus the incurred loss approach (see Note 1).

The impacts described here are contingent on CECL being implemented in March 31, 2020 reporting as planned, with banks taking advantage of the regulatory capital phase in option published on March 27, 2020.

How will bank’s CECL allowances change in a crisis scenario?

Our analysis suggests that CECL allowances of the largest US banks (see Note 2) might triple or even quadruple if a severely adverse economic scenario, similar to the financial crisis of 2008-09, were fully factored into CECL estimates.

In Exhibit 1, we show the largest banks’ current allowances (as of December 31, 2019) and the expected impact of CECL as reported in banks’ 2019 annual reports — a 24 percent allowance increase at the time when the economic outlook was much better than today. We use historical credit loss rates from the financial crisis of 2008-09 and the banks’ Dodd-Frank Act Stress Test 2019 disclosures to show how much higher allowances might be if they moved from benign forecasts in January to a severely adverse scenario.

Possible Impact of CECL under stress scenarios

Coronavirus could have a significant impact on reserves if stress scenarios become the expectation by March 31, 2020.

Allowances for the Top 9 US Bank Holding Companies (BHCs) ($ BN)

Source: Federal Reserve; BHC DFAST 2019 Disclosures; Banks' 2019 annual reports and 10K filings; Oliver Wyman analysis.

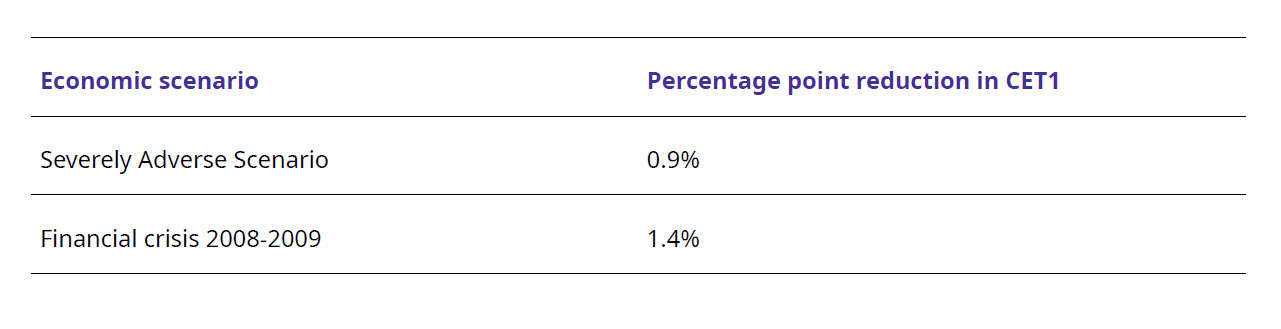

How will this impact a bank’s capital?

The impact on banks’ capital will be potentially large and will depend on the severity of the scenario assumptions incorporated into banks’ CECL allowance calculations. Our analysis suggests that under the joint agency phase in option released on March 27, 2020 banks’ capital ratios could be reduced by up to 0.9 percentage points on March 31, 2020 assuming a severely adverse scenario or by up to 1.4 percent in a more extreme in a 2008-09 financial crisis-like scenario (see Note 3), as shown in the table below. The impact, of course, will differ considerably by bank.

Impact on CET1 ratios based on allowances fully flowing through to retained earnings

What else needs to be taken into consideration to determine the CECL impact?

There are more considerations to determine the impact on bank’s CECL allowances. Most large banks are using a weighted average of multiple scenarios, so some probability of a downturn is already captured in their estimates. We also note that the impact of a coronavirus-related recession will be different to the broad downturn scenarios envisioned above — with acute stress on specific industries (for example, airlines, hospitality) and milder or even positive impacts on others (for example, digital communication services). Meanwhile, the impact on retail portfolios will differ significantly by geography, depending on how quickly the virus spreads and the impact of containment measures. Banks will be well-advised to adjust their model-based estimates based on careful analysis of their portfolios.

What should financial institutions do?

In the absence of action to postpone the implementation of CECL, we recommend that financial institutions immediately assess the impact of various economic scenarios by using their own models and by applying their own CECL accounting framework to update forecasts (as appropriate for the March 31 reporting). In addition to macroeconomic scenarios, these scenarios should also consider pandemic-specific considerations (including containment actions) which capture microeconomic impacts on borrowers (either at the industry/geography-level or, where appropriate, at the name level), adjusting estimates to the specific scenario playing out. Institutions should also carefully communicate and comment on their disclosure of CECL allowances to investors once results are released.

Most importantly, institutions should monitor credit exposures in the worst-affected industries and geographies — proactively working with clients to reduce their risk and manage through the situation.