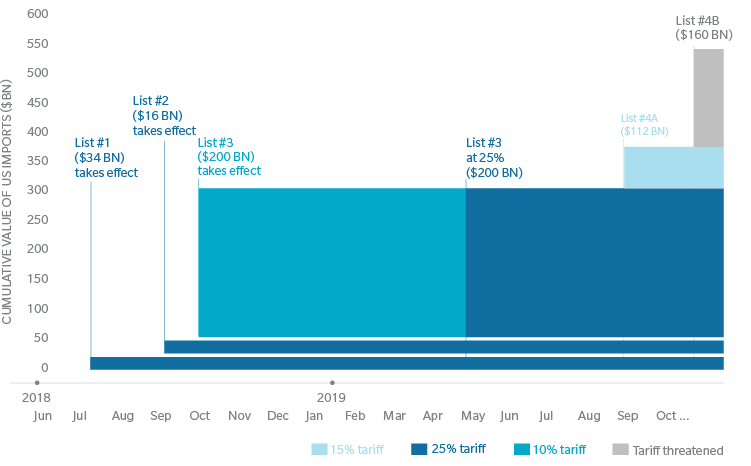

For the latter list, the US raised tariffs to 25 percent in May 2019, imposed additional tariffs on $112 billion worth of goods in September 2019 and threatened tariffs on $160 billion worth of goods. Despite a tentative agreement for a “first phase” of a trade deal, tariffs on Chinese goods may remain for a “substantial period” according to both the US government and analysts. (See Exhibit 1.)

Exhibit 1: Evolution of US 301 tariff actions (incl. threatened tariffs) as of October 28th, 2019

Source: Oliver Wyman analysis

Firms have responded. As early as September 2018, a supplier to major multinational computer technology companies said that it was considering relocating its motherboard production line to Taiwan. One of the world’s largest tech companies has shifted substantial smartphone assembly from China to Vietnam. Companies have started to answer questions on the impact of tariffs and mitigation options.

ANY INDUSTRIAL FIRM CAN POTENTIALLY BE IMPACTED

Section 301 of the 1974 US Trade Act provides the United States with the authority to address what it calls “trade practices related to the forced transfer of [American] technology and intellectual property” by imposing tariffs. Specifically, these tariffs are applicable to companies that import products to the US and operate in industries such as aerospace, information and communication technology, robotics, and machinery. More generally, however, the US International Trade Administration targets “products that benefit from China’s industrial plans.” This implies that companies need to have a clear understanding of the origin of their products and components.

Tariffs may be imposed on the full value of a product if one or more of a product’s components have a code or number on one of the tariff lists and where the country of origin is China. Generally, the more parts there are on any of the lists, the higher the probability that US Customs or a US court will find the product to be Chinese and therefore subject to the tariff.

Companies will need to assess value-add to us imports that have china content or else can expect cost increases of 25% on these imports

SUBSTANTIAL TRANSFORMATION IS THE KEY CRITERION

When assessing a product’s country of origin, the qualitative “substantial transformation” test is used. The test considers, among other criteria, where key components originate and how complex the manufacturing processes are in different countries. It is important to note that there are multiple ways to establish the country of origin. It may be determined by final assembly location, where major components (or the majority of them) are manufactured, or where key transformations occur.

Due to the legal complexity and case-by-case approach of authorities, performing due diligence is highly recommended to assess tariff impact. Any importer needs to demonstrate “reasonable care” to avoid penalty payments or legal prosecution should it have to revise the country of origin after an investigation. This becomes even more important, as a product’s origin can be challenged each time it is imported. Since the US Customs and Border Protection (CPB) Headquarters Ruling H300226, the CPB has determined that the country of origin for NAFTA and 301 tariff purposes may differ, other or previous rules may not apply, making tariff risk challenging.

HOW CAN COMPANIES RESPOND?

For companies importing goods with China origin or content as outlined above, we recommend a risk assessment and mitigation strategy. A pragmatic, top-down approach is advised:

Understand 301 tariffs: When assessing the manufacturing and supply chain, companies should seek legal counsel, with input from engineering, purchasing, and manufacturing experts.

Tariff impact determination: Examine the Bills of Materials for imports and understand the value and character of parts that are on 301 tariff lists or from China. In addition, companies should identify key major manufacturing steps, noting the sophistication of the activities and their locations. The resulting insights will allow them to evaluate the probability of applicable tariffs and quantify the potential impact on costs.

Operational mitigation option development: Companies should involve stakeholders across departments to innovate mitigation options. These may be ranked based on success probability, effort, and timeline. Potential actions of competitors should be taken into consideration, both in terms of market pricing and their commitments to suppliers; likewise, consider suppliers’ potential reactions to both your company’s and your competitors’ actions.

Evaluation of change: Depending on the strategy chosen, changes to manufacturing processes, BOM content, and/or suppliers could result. Any business case for change should at least be validated at a 0 percent, 10 percent, and 25 percent tariff level, as these may change quickly.

Implementation: Currently irreversible actions to supply chains and operations should be carefully considered. It could still be the case that tariffs are only temporary. However, if a change makes sense at a 0 percent tariff level, it may be undertaken in any case.

COMBINING LOW-EFFORT MITIGATIONSTRATEGIES MAY YIELD SUCCESS

While the simplest mitigation strategy may be passing through tariff-related costs to customers, this is not always the best course in a competitive market. Even in an uncompetitive market, cost-based mitigation strategies should be evaluated to maximize earnings. Strategies can be examined by department and combined to increase success probabilities. From a legal point of view, companies may choose to lobby, apply for exceptions or identify tariff mitigation options based on product usage.

In addition, firms can request duty reclamations. Engaging in a quotation process and potentially changing suppliers to those in countries other than China may be a feasible mitigation strategy, though re-validation costs need to be weighed.

To summarize, companies should start by carrying out a risk assessment, involving a clear understanding of tariffs and their impact. Next, undertake a structured, top-down approach to evaluate the most relevant mitigation strategies. Ultimately, the real challenge is knowing what to do in the period of uncertainty to mitigate risk and to be nimble once the tariff decisions are made.