Meanwhile, Asian rivals, particularly those based in Korea and China, have increased revenues on average of 7 percent annually between 2011 and 2016, and emerging markets players currently have 40 percent of the global market. German companies have fared even worse than those in the rest of Europe: Their revenues declined an average of 2.1 percent per year between 2011 and 2016, and profitability is lagging too, at an average earnings margin of 4.4 percent.

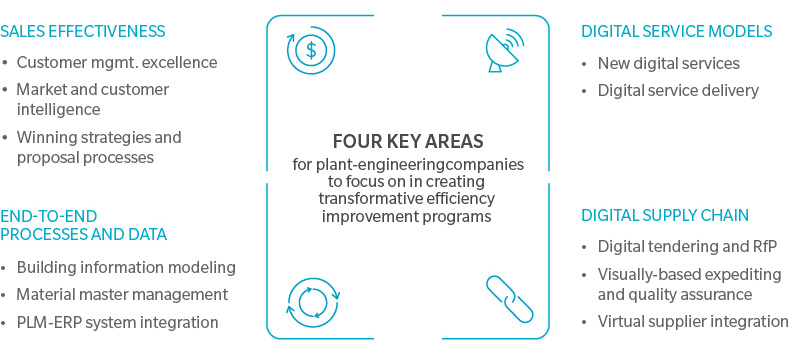

To bring their capacity into alignment with costs, most major European plant engineering firms have cut workforces by between 15 and 30 percent. This has involved site closures, divestments of unprofitable businesses, overhead optimization, and shifts of capacity to lower-cost countries. Now, in times of strongly improved general market conditions, these companies will need to rethink overall strategies to deliver projects with reduced capacities, remain competitive, and participate profitably in the new growth. They will have to transform traditional business processes, and make the most of new digital technologies by exploiting data in their operations. There are four key areas that they should address immediately. (See The Exhibit.)

Typical agenda in plant engineering

Source: Oliver Wyman analysis

Pushing sales effectively to regain market share

European plant-engineering companies have strong prospect pipelines again. Still, they face increasing pressure from emerging competitors, so they must both select the right opportunities to bid on and increase their rates of success. Doing so will require a better understanding of client and project requirements, which can be gained by drawing closer to customers and building systematic intelligence on markets and accounts. Holistic customer segmentation can improve firms’ client-base knowledge through the better use of data in such areas as past sales, future potential, and profitability, and in enhanced qualitative information on buying behavior, products, and service. Firms thereby will be empowered to develop deeper market strategies and tailor activities to meet customer demands.

Traditionally, European plant-engineering firms have considered their superior technological competencies to be their unique selling proposition, and have focused sales efforts on these. In the future, by dividing roles between business development and sales, firms should be able to simultaneously leverage technical strengths and improve customer management.

Developing new digital service models

Recently, customer demand has shifted from just building additional capacity, to increasing overall equipment effectiveness and productivity. Consequently, plant-engineering companies should develop new, digital service models that offer additional value to clients. In particular, service delivery can be made more efficient by digitizing existing services to apply big data, machine learning, and process automation. The industry has already seen some rollouts, including: remote maintenance and services, condition-based services, the extensive use of sensor data, as well as the use of machine-learning techniques.

The digital age also provides opportunities for new services, such as automated asset inspection via drones and georeferenced orthophotos analyzable for front-end engineering design. Digital twins of the real plant will form the basis of future service models that last the entire lifecycle of a plant. Such developments present new opportunities, but European plant-engineering companies will have to become adept at identifying them and investing early to develop new capabilities.

>10% reduction in product cost and lead time through end-to-end and digital processes.

Taking a modularized approach toward design and building

Digitization of plant-engineering value creation and processes will be a third lever of efficiency, with building information modeling (BIM) the key driver. Companies will need to build end-to-end integrated processes that match the requirements of BIM, and adjust IT systems accordingly. This will improve design-to-construction, design-to-procure and the reuse of equipment in a modularized plant and product configuration. Companies will see both reductions in product costs and lead time of more than 10 percent.

With the modularized execution approach, it will be necessary to further integrate engineering and construction functions to increase on-site efficiency and ensure efficient designs in the early phases of a project. This will be particularly critical for small and midsize plants, as well as those that are more standardized. Moreover, effectively aligning different technology and engineering disciplines will produce higher-quality designs at a lower cost. Systems for 3D CAD are already migrating onto the cloud, allowing engineers to work on the same, integrated data model. Note, however, that while such changes will promote efficiency, they will also require new methods of collaboration.

Digitizing the supply chain to create value

Finally, plant engineering companies should digitize supply chains to boost efficiency and reduce lead time. The scope of digitization efforts would thus be expanded to include not only BIM but also a company’s supply side operations. Stronger integration of supplier standards into plant engineering value creation and digital requests for proposal (RfP) will increase supplier efficiency and reduce the costs of materials. Plant-engineering companies can further reduce their process costs for purchasing, expediting, and logistics by greater transparency along the value chain. Smart glasses, for example, together with more strategic cooperation between companies and their suppliers, could offer new, sight-based methods of quality control and expediting, and could accelerate these processes significantly.

To go beyond cost cutting, established plant engineering companies will have to make significant efforts to transform their businesses at a time when market conditions are likely to remain difficult. If they make the right investments now, however, they could see their competitiveness enhanced in the near future.

About Authors

Wolfgang Weidner is a Munich-based partner in Oliver Wyman’s Automotive and Manufacturing Industries practice and focused on plant engineering organization and cost and efficiency optimization. Bo Kaunitz is a Stockholm-based partner in Oliver Wyman’s Automotive and Manufacturing Industries practice and focused on mergers and acquisitions, strategy development and digital transformation.