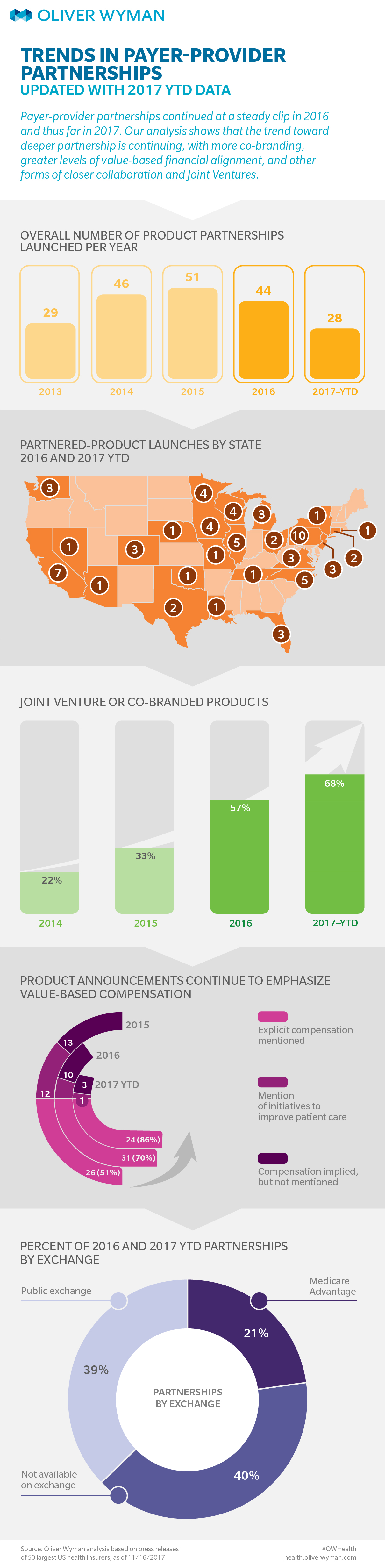

For the past five years, Oliver Wyman has been tracking payer-provider partnerships and reporting on trends in the space. This infographic includes new data from 2017. To-date, payer-provider partnerships continue to deepen, with 68% partnerships launched in 2017 being joint venture or fully co-branded insurance products.

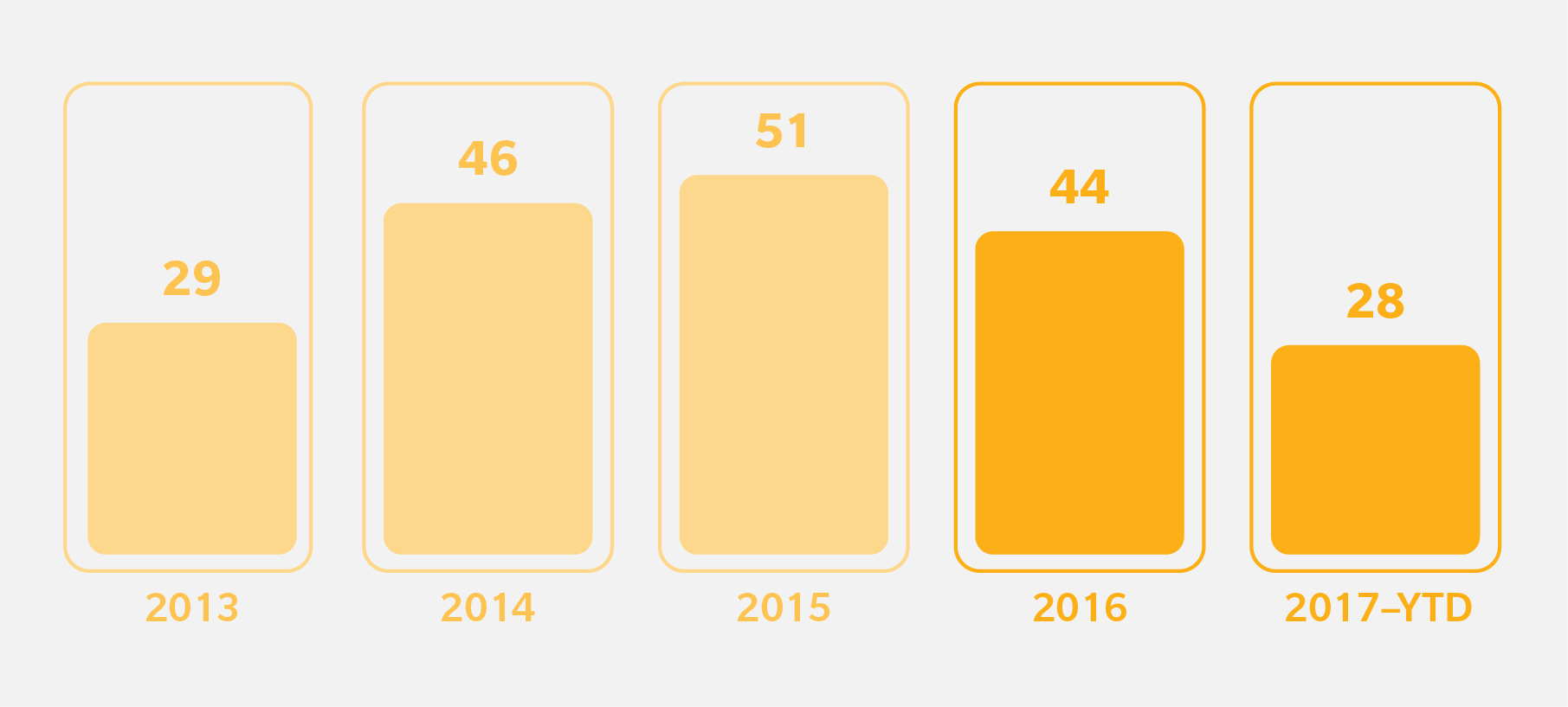

About 200 partnerships have been launched in the last five years that involve the 50 payers that we have tracked over time. A significant number of new partnerships continued to be announced, even as payers focus on building deeper partnerships and investing in existing relationships.

Notable Recent Updates

- Aetna continues to be a leader in launching payer-provider partnerships by announcing additional Aetna Whole HealthSM products with provider partners.

- Cleveland Clinic expressed strong appetite for working with payers more closely, with three products announced for 2018 with Anthem, Humana and Oscar Insurance, across Medicare Advantage and Individual / Family segments.

Future Outlook

Narrow networks were just the first wave of partnerships. To make the most of these relationships, participants are now increasingly betting on closer clinical and operation alignment. The next wave of deeper relationships we see focus on patient/member experience, cost of care management, and more non-traditional capabilities of enablement and start-up players to drive further differentiation. As an example, Oscar Insurance and Humana announced a partnership for small-business health insurance in Nashville. As Oliver Wyman partner Tom Robinson mentioned recently in The New York Times, it is too early to tell whether these partnerships will deliver on the promises, but it certainly indicates that the game is changing and that traditional health plans and providers are looking beyond price and volume negotiations to unlock value greater for patients and plan sponsors.