ACCELERATING TECHNOLOGY TRANSFORMATION

Retail Media Presents New Business Opportunities

Traditional retailers have long sold advertising space on media such as in-store radio, but many have not given enough attention to the expanding opportunities. They are now playing catch-up in a $100 billion market, as the growing value of their first-party data presents an opportunity for a more significant source of revenue. We estimate that the biggest global retailers could expand retail media into 2% or 3% of their revenues [1].

Retail media is a means for a variety of goods and services companies to target customers by developing a 360-degree understanding of them. The definition has expanded in recent years, from physical installations — such as gondola ends, power aisle displays, and car park banners — to sponsored search results and display advertising in apps and on e-commerce sites. Now, retailers are becoming increasingly sophisticated as publishers that monetize their physical and digital footprints. They collect, analyze, and share data with brands and product manufacturers in faster, more-intelligent ways, and the resulting customer insights can be applied to a greater number of touchpoints. These include off-site media accessed through Google, Facebook, and display ad exchanges, and their use can extend retailers’ saleable media space several times over

Why the Value of Data Is Rising

The first-party data gathered by retailers are becoming increasingly valuable. To gain insight into consumers, product makers need data, but these are becoming harder to obtain, as data protection grows in importance to consumers: Eight out of 10 are willing to act to protect their personal data, according to a 2021 survey [2]. Their concerns have been reflected in regulations, such as the European Union’s General Data Protection Regulation (GDPR), which came into force in 2018, and in company policies, such as Apple’s restriction of App Tracking and Google’s phase-out of third-party cookies. First-party data gathered by retailers are an alternative, and they are especially useful because of the strong relationships many brickand-mortar retailers have with their customers. Their data also provide explicit evidence for interest in a product: Someone might “like” an online photo of a dog even though they do not have a dog themselves — but if they buy dog food, they almost certainly do have one.

For example, a shampoo maker can use insights from the retailer’s data to design a country-wide branding campaign. And it might also advertise on a retailer’s in-store TV walls and self-checkout terminals. But the greatest value will come from being able to target specific customers, especially with digital ads. Retailers can also attract new advertisers — for instance, a travel insurance company that wants to sell to consumers who are buying travelrelated products such as sun cream.

Optimal results come from combining hard facts about turnover and specific transactions with external information on consumer habits and media use. Later, manufacturers and retailers can recognize which campaign has activated which customer at which location, enabling them to target their advertising more precisely.

Growth Potential

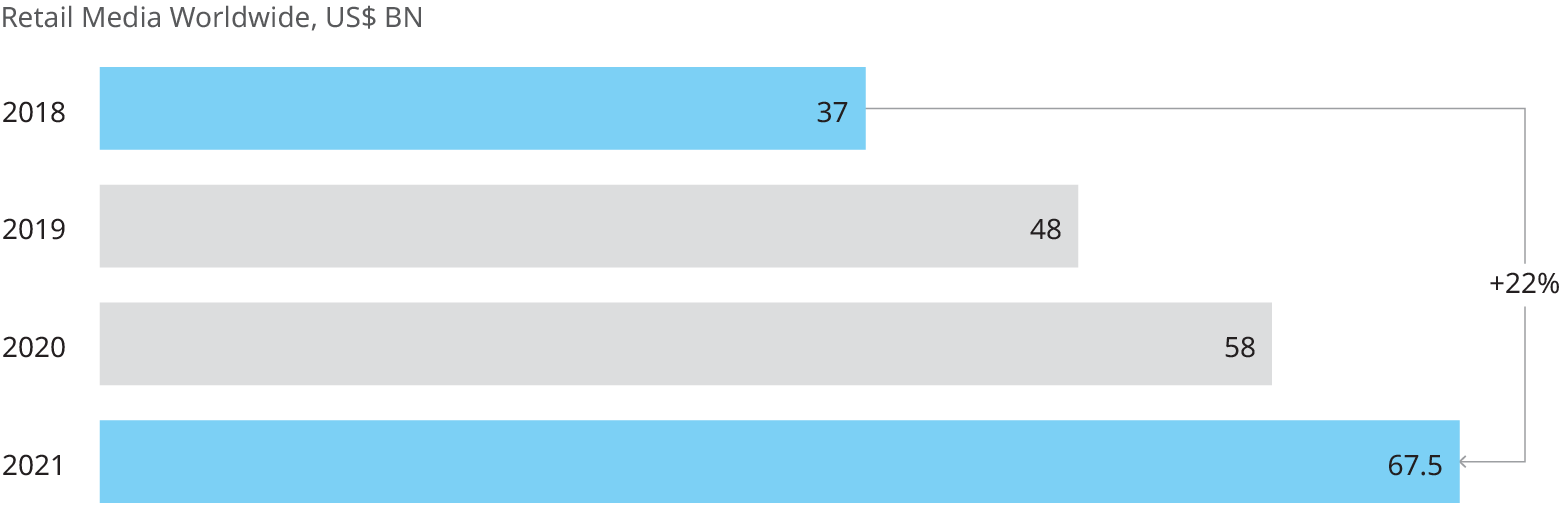

Global retail media sales have achieved average annual growth of 22% in recent years, but the potential depends on the scale and nature of individual retailers. Small brick-and-mortar stores could set up retail media as a side activity and expand sales to between 0.2% and 0.3% of their total. For the world’s online giants, retail media could amount to between 5% and 7% of their sales [1]: They are already focused in this area and are leaders in the technology. Big, global retailers, which could turn retail media into up to 3% of revenues, would benefit from turning retail media into a strategic asset, by developing their digital presence and investing in technology. (See Exhibit 1).

Exhibit 1: The Major Marketplaces Are Now Securing the Bulk of the Retail Media Business

Source: RMM, Zalando financial statements, Oliver Wyman analysis

There are three pillars to a successful implementation: a strategy, an organization, and the technology.

01

Strategy. A retailer first needs to develop a strategy with target groups, use cases, concrete goals, and performance indicators. It should figure out what its retail media product looks like — the advertising space it will offer, plus additional services such as analytical support. It will also need to establish the main potential customers, a commercial model, and a pricing structure. It can then market both its own and thirdparty digital advertising space.

Organization. Implementation requires a salesforce with media and agency experience: Media professionals understand the needs of the product manufacturers, in particular the new target group of brand managers. The new team should be given as much autonomy as possible, including responsibility for its sales and earnings. A retailer also needs an in-house performance marketing team, which uses strong technical and analytical skills to understand retail customers and plan effective campaigns. It also optimizes ongoing campaigns using key performance indicators and A/B tests.

In addition, a retailer needs to figure out the go-to-market process, including the workflows between retailers, suppliers, and other partners.

It also needs to examine the business case — for example, whether funds can be fully secured in the first year.

02

03

Technology & Data. Retailers should form a target picture for technical implementation, including likely costs, timeframe, risks, advantages, and disadvantages. There are three main success factors. First, all data generated online and offline must be consolidated in a secure manner that complies with data-protection standards. Second, the retailer should market its own platforms using sophisticated technologies such as Google Ad Manager and Google Marketing Platform, which can be integrated into existing technology systems. The integration of thirdparty advertising space and offsite media purchasing also play an important role, in particular through Google’s ad network, from the Google Display Network to YouTube. Third, modern analysis tools are needed to continuously measure and automatically evaluate online and offline activities.

Now Is the Right Time

Currently, well over half the global total of retail media sales come from Alibaba and Amazon4, and most traditional retailers severely under-market their digital media and knowledge of customer needs.

But many retailers are becoming aware of the opportunities. And product makers are increasingly willing to spend more on retail media, because of the value of the data from transaction points and the ease with which they can measure the results of their marketing investments. Greater use of retail media can benefit both parties.

[1]

Goldman Sachs Report “The Merchant-Media model: A new era for retailers as ad platforms", Feb. 2021.

[2]

Cisco data privacy survey June 2021